Эта запись также доступна на: Russian

French

Portuguese (Brazil)

A demo account is offered as a safe way to test new trading systems. It is often recommended to beginners and those who are not yet sure about their desire to trade. At first glance, a demo account contains only pluses, but some analysts consider it useless and even dangerous for a trader. In this article we propose to understand how trial trading can harm a businessman and how to avoid unpleasant situations.

Risks of using a demo account

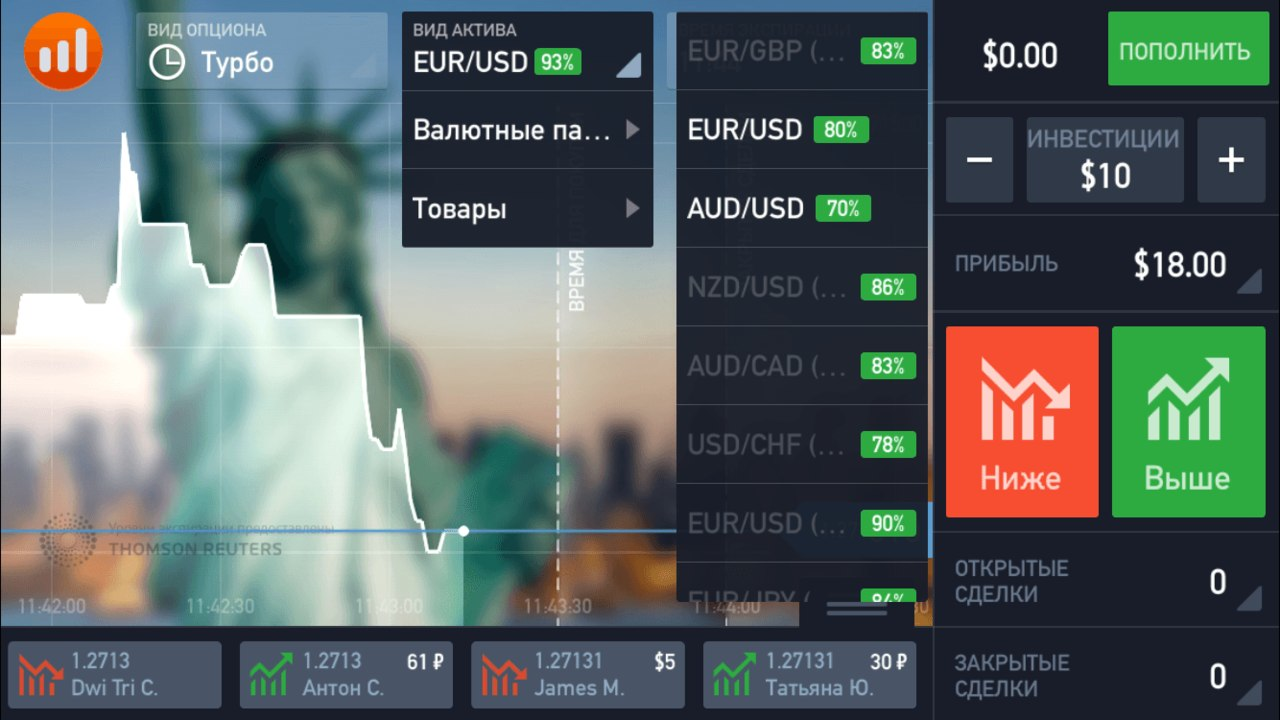

First of all, a novice investor should understand what a demo account is. This includes trial trading, which is done on a virtual platform and does not require monetary contributions. To get access to such bidding, you should fill in a few fields with personal data and then activate the system.

Demo account registration is very quick and easy. It will only take a few minutes, and after that the trader will be able to fully use the program for strategy testing or training. On a demo account you can get a full simulation of real trading: place orders and stops, receive currency on deposit and lose your earnings due to erroneous trades.

It is considered a good idea to open a demo account, but during its use there are pitfalls that you should learn about in advance. The price indicators on this tariff work late, which means that all results are confused and reflected differently than in real time. When the server load is high, hang-ups may occur, brokers do not have time to change the price and the trader gets a completely different financial result.

After switching to a real account, the investor will notice a lot of inconsistencies and will have to look for a new behavioral strategy. Techniques that worked great on demo will be unsuitable for trading with real money.

Another disadvantage of demo accounts is that there is too little psychological pressure on the player. He does not worry about losing his deposit, because he works with virtual money and does not care about it at all. A person loses excitement, which means that the internal mood is not at all similar to the experiences during the real trading period. Starting to work with his own money, a person will be amazed by the huge number of difficulties and with a high probability will show a worse result than on the demo.

How to safely use a demo account on the stock exchange?

Despite all the flaws, a demo account can be put to good use:

- It should only be used as terminal training. This is a good opportunity to try out the functionality and fully understand it.

- You should not stay on a demo account for a long time, so that you don’t get used to its working conditions. After learning the terminal, it is recommended to go straight to the real tariff.

- If there is a desire to test the strategy, you should do it on your own deposit, but invest relatively small amounts in the test. It is better to spend a couple of dollars getting quality and reliable testing than to save money and perform a useless analysis. Demo and live account performance is too different to draw conclusions from trading on Demo.

- The perception during test bidding is very different, because the person is not worried about the lost funds. Therefore, you should not unconditionally believe the successes obtained in testing.

- The use of Demo for testing is available only to professionals, because they evaluate the market behavior and its reaction to the placed orders, not their own abilities. As a rule, only risky strategies that cannot be tested with your own deposit are tested in this way.

When getting a useful tool at your disposal, it is necessary to intelligently consider its use. If you use demo accounts thoughtlessly and rely too much on their results, you will have serious difficulties when working with your money.